What Will Be the Underwriter Considerations Under Escalation Clause

Underwriting is a crucial method that is used by insurers to analyse and assess the risk of insuring an individual’s health, life, property, car, business, etc. among other things. This process helps an insurance company determine the risk factors that could heighten its chances of having to pay out an insurance claim and thus gauge the profitability of providing coverage to the concerned entity. An underwriter is the person who is responsible for performing this extremely important job, making them a key player in the functioning of an insurance company.

After conducting a thorough risk assessment, the insurance underwriter takes a call whether the company should accept or refuse taking on a policy depending upon the level of risk they pose for the company. If the financial risk of payout is too high, then they advise the company to decline offering insurance coverage to the individual or entity in question. But if an individual presents an acceptable level of risk, then the underwriter calculates and charges a fair price to be paid by them to the insurance company for the premium. So to sum it up, the insured individual transfers their risks to the insurer, which charges a premium to lend them financial assistance in case of a loss.

Insurance underwriting is applicable to all types of insurance. But in this blog, we will be focusing on underwriter considerations under the escalation clause, which is a feature that falls under commercial property insurance. Let us start with a brief introduction to commercial property insurance.

What Is Commercial Property Insurance?

A commercial property insurance policy offers financial protection to the equipment or physical assets of a commercial property from losses caused due to fire, theft, natural disasters, and a number of other dangers. Retail firms, manufacturing companies, not-for-profit organisations and service-oriented businesses can avail this type of insurance. It can either be an all-risk coverage policy that covers every possible financial risk or operational risk under one policy, or it can also be a named-risk coverage policy that protects the insured only against those dangers that are specifically mentioned in the policy document.

What Is Escalation Clause?

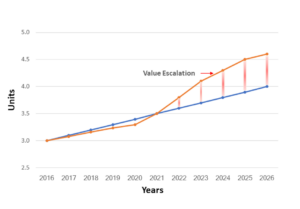

The provision of an escalation clause in a commercial property insurance contract allows for an increase in the insured sum to cover any unanticipated costs triggered by fluctuations, such as, for example, the rise in prices of physical assets owing to inflation. This clause is also referred to as the inflation-guard endorsement in the business of insurance, as it effectively aids in increasing the insurance coverage based on the current cost of raw materials, labour, and more.

While buying a commercial property insurance policy, it is necessary to take inflation into consideration to avoid being underinsured. An escalating inflation rate can increase the price of any commodity or goods, so it is never a good idea to skip the escalation clause in the insurance contract to save money. In a situation where the insured has cancelled the escalation clause and should a loss occur to their commercial property, then the insured may have to shell out a lot of extra money from their own pockets to pay for the damages as per the prevailing market prices. On the other hand, with the inclusion of an escalation clause, the insurance claims management takes into account the growth of the assets over time to extend adequate coverage that is consistently in sync with the current market scenario.

Underwriter Considerations Under Escalation Clause

While underwriting and rating a commercial property, property insurers have to consider several crucial factors, especially while allowing the extension of an escalation clause. These considerations help the underwriters diminish threats, curb deficiencies, and improve their bottom line.

Below is a list of the important factors that commercial property underwriters must consider under an escalation clause:

- Realistic valuation of assets

To decide if a commercial property can be insured or not, the first thing that an underwriter does is get a realistic valuation of the assets owned by the business organisation. This process involves taking an inventory of all the physical assets used by the business in its operations. Doing this helps the underwriter give an accurate estimate of the amount of coverage that the business should get when an insurance claim is made. - Nature of business

An insurance underwriter must have complete knowledge regarding the exact nature of the business being carried out on the commercial property, the type of inventory it has under its roof, the kind of machinery or equipment it may be using, etc. to figure out in advance if there is scope for any operational risk that may lead to financial risk in the future. - Assess the potential of growth of assets

Owing to the ever-rising costs of products and services, the replacement costs of the assets in case of an event of loss may be much higher than the property’s insured value. Therefore, to lower the risk of underinsurance, the underwriter must take into account the potential of growth of the business’s assets to accurately determine their replacement value under the escalation clause. This enhances the underwriter’s ability to charge premiums proportional to their risk, quantify exposure better, and also helps them to give information to customers about adequate policy limits. - Internal controls

An insurance company’s internal controls are a vital part of their risk management system. An internal control framework comprises accounting and administrative procedures, appropriate arrangements for reporting, and a compliance function. Internal controls aid in promoting accountability and preventing fraud, and an insurance underwriter must abide by them when underwriting an insurance policy under the escalation clause. - Internal audit

During internal audit, the auditor reviews methodologies used by the insurance underwriter to make sure that they are in sync with financial standards. The underwriter provides the auditor with all the necessary information about their analyses, and the auditor in turn scrutinises all the calculations and justifications made by them. - Background of the insured and past claims

An underwriter has to conduct a thorough background check of the individual to be insured to check if they are eligible for getting the insurance coverage with the escalation clause extension. The underwriter checks the credit history of the individual to evaluate their insurability and also goes through their previous insurance policies to see if they have made any insurance claim in the past. - Proposal form

When an individual decides to buy a commercial property insurance policy, they have to fill out a proposal form, which is a legal document seeking relevant information for the insurance company to understand them in depth. It seeks a lot more than just basic details such as name, gender, age, address, etc.; it acquires vital information that is used by the underwriter to assess the individual’s eligibility to be insured. - Findings of risk survey

Through a risk survey, an insurance underwriter discovers any critical conditions or hazards on the property that have a major likelihood of contributing to loss. Usually, a field analyst documents the damage through photographs and detailed information that they share with the underwriter. This allows the underwriter to send forth recommendations to the property owner so that they can remove those hazards from the property. The information included in risk improvement recommendations enables the underwriter to calculate an accurate price for the insurance coverage under escalation clause. It also helps them offer a valuable cost-benefit analysis for the recommendations they make. - Location

The underwriter must curate complete data about the property premises as well as about any structures neighbouring the property for risk management purposes – in terms of any potential threats that they may present to the property. For instance, if the property is located near a storage tank containing flammable liquids, it can be vulnerable to serious dangers such as fire hazards. This critical data about liability exposures can assist an underwriter to accurately assess the property to be insured and charge the appropriate premium under the escalation clause. - Exposure to NAT-CAT perils

While underwriting an insurance policy for a commercial property under an escalation clause, the underwriter must also consider the additional exposures that may put the property to be insured at risk, including NAT-CAT perils like:- The proximity of the property to an earthquake zone

- The risk of damage-inducing windstorms, flooding, and more

- The possibility of wildfires, etc.

Therefore, these are all the important considerations that an underwriter has to take into account under an escalation clause before coming up with an insurance contract.

To get the right insurance solutions, get in touch with Deinon Insurance Brokers LLC, one of the prominent corporate insurance brokers through our website https://deinon.ae/property/ or drop us an email at infra-energy@deinon.ae.